Since yesterday’s budget, much has been written about the microscopic tax cuts.

Hard-pressed taxpayers will welcome any relief, but the modest size of the unexpected personal income tax cut in this week’s federal budget – at most $5 a week from July 2026 and $10 from July 2027 – makes it a sitting duck for ridicule.

and

Notwithstanding the incentive considerations, this government appears to have chosen a cut confined to the lowest rate so that it could stick to its “tax cut for everyone” slogan.

David Pearl in the Australian:

The biggest surprise in the budget is a laughable income tax cut of $268 from mid next year and $536 from July 1, 2027. This is the tax cut you offer when you don’t want to cut taxes.

But for one glimmer of hope in the budget papers. The government’s plan to cut the marginal tax rate in the first tax bracket from 16 per cent to 14 per cent over the next two years has been widely underestimated. It should not be considered in isolation. It represents a genuine improvement in economic incentives and augurs well.

and

This tax cut agenda is the one clear signal we’ve received that the treasurer understands what needs to be done to restore our prosperity. If he is returned at the election, he’ll have a second chance to prove it. It’s unlikely he’ll be given a third.

No doubt many others have made comment.

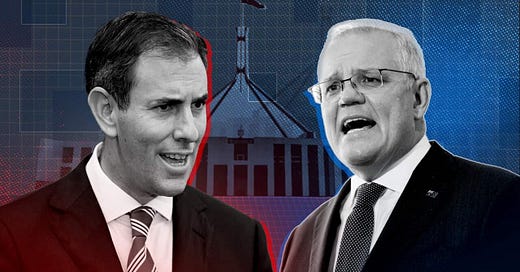

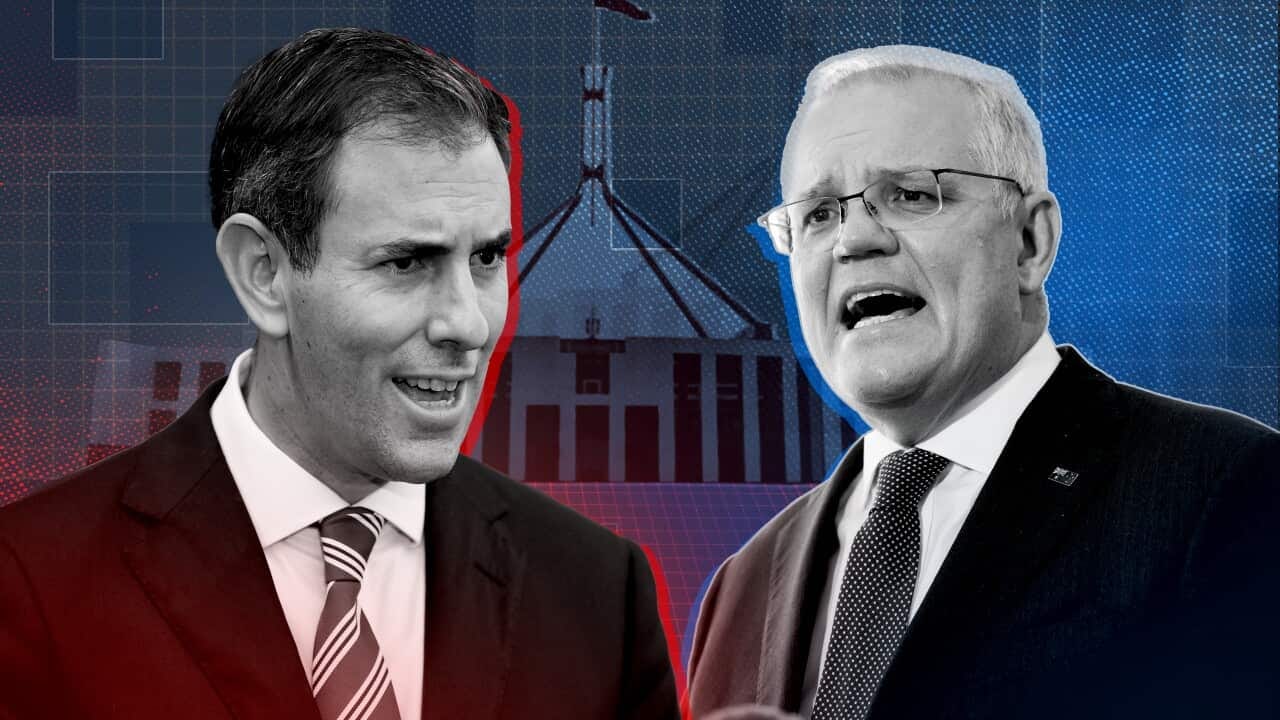

Sparty’s 10c? These tax cuts were so cynical Scott Morrison would be smiling on them, impressed with the scheming in Chalmers’ office.

To Hamilton’s suggestion that “treasurer understands what needs to be done to restore our prosperity”.

Bollocks. What the Treasurer understands is what is necessary to wedge the opposition and to position himself for the Prime Ministership.

Yes. Every tax cut is good. But this had nothing to do with economics or prosperity. The calculus is clear. Follow the decision tree:

Opposition supports and opposition wins election. This cut (and the spending) squeezes near every single ounce of fiscal headroom for the new government while Chalmers is new opposition leader.

Opposition supports and government wins election. This cut (and the spending) positions Chalmers as Albanese’s successor, if they are elected, leaves them negligible fiscal space to do anything.

Opposition opposes and opposition wins election. New opposition leader Chalmers can label new Prime Minister Dutton as anti worker and a high taxer for opposing the tax cut.

Opposition opposes and government wins election. Same again. Invigorated Treasurer Chalmers, ready to replace Albanese as Prime Minister will hammer Peter the Punching Bag as anti worker and a high taxer for opposing the tax cut.

No matter what, Chalmers wins. But taxpaypers and the next generation left with the debt lose.

Cynicism, a-la Morrison.

There is 1 winner out of this!

$2 shops!